Although the accrual method of accounting is labor-intensive because it requires extensive journaling, it is a more accurate measure of a company’s transactions and events for each period. This more complete picture helps users of financial statements to better understand a company’s present financial health and predict its future financial position. The effect of this journal entry would be to increase the utility company’s expenses on the income statement and to increase its accounts payable on the balance sheet.

- If the secretary of state determines that a filing has been made in error by the cooperative, the secretary of state may revoke and expunge the erroneous filing and authorize a curative document to be filed.

- Termination in either manner revokes all prior proxy appointments and is effective when filed with a manager of the cooperative.

- (a) A member who knowingly, intentionally, or repeatedly violates a provision of the articles, bylaws, member control agreement, or marketing contract with the cooperative may be required by the board to surrender the member’s voting power or the financial rights of membership interest of any class owned by the member, or both.

- Subject to any limitation in the articles or bylaws, the board may fix the compensation of the directors.

- Accrued expenses make a set of financial statements more consistent by recording charges in specific periods, though it takes more resources to perform this type of accounting.

- A company usually does not book accrued expenses during the month; instead, accrued expenses are booked during the close period.

.211 COOPERATIVE NAME.

Membership interests reflected in the required records in the name of a trustee in bankruptcy or a receiver may be voted by the trustee or receiver either in person or by proxy. Membership interests under the control of a trustee in bankruptcy or a receiver may be voted by the trustee or receiver without reflecting in the required records the name of the trustee or receiver, if authority to do so is contained in an appropriate order of the court by which the trustee or receiver was appointed. The right to vote of trustees in bankruptcy and receivers is subject to section 308B.545.

Subd. 9.Liability of subscribers and members with respect to membership interests.

(6) allocate the value determined under clause (5) proportionally among the old contributions pertaining to the particular series or class, add the allocated values to those old contributions, and change the required records accordingly. A restriction on the transfer or registration of transfer of membership interests of a cooperative may be imposed in the articles, in the bylaws, by a resolution adopted by the members, or by an agreement among or other written action by a number of members or holders of other membership interests or among them and the cooperative. A restriction is not binding with respect to membership interests issued prior to the adoption of the restriction, unless the holders of those membership interests are parties to the agreement or voted in favor of the restriction. On application to a court of competent jurisdiction by any judgment creditor of a member, the court may charge a member’s or an assignee’s financial rights with payment of the unsatisfied amount of the judgment with interest. To the extent so charged, the judgment creditor has only the rights of an assignee of a member’s financial rights under section 308B.605.

Accrued Expense vs. Accrued Interest: What’s the Difference?

“Nonpatron membership interest” means a membership interest that does not require the holder to conduct patronage business for or with the cooperative to receive financial rights or distributions. “Membership interest” means a member’s interest in a cooperative consisting of a member’s financial rights, a member’s right to assign financial rights, a member’s governance rights, and a member’s right to assign governance rights. Membership interest includes patron membership interests and nonpatron membership interests. “Filed with the secretary of state” means that a document meeting the applicable requirements of this chapter, signed and accompanied by the required filing fee, has been delivered to the secretary of state.

Subdivision 1.Quorum.

(b) The board may implement the use of districts or units, including setting the time and place and prescribing the rules of conduct for holding meetings by districts or units to elect delegates to members’ meetings. (b) The termination of a proceeding by judgment, order, settlement, conviction, or upon a plea of nolo contendere or its equivalent does not, of itself, establish that the person did not meet the criteria set forth in this subdivision. (d) “Proceeding” means a threatened, pending, or completed civil, criminal, administrative, arbitration, or investigative proceeding, including a proceeding by or in the right of the cooperative. (3) a committee of the board upon which the director does not serve, duly established by the board, as to matters within its designated authority, if the director reasonably believes the committee to merit confidence. A director shall discharge the duties of the position of director in good faith, in a manner the director reasonably believes to be in the best interests of the cooperative, and with the care an ordinarily prudent person in a like position would exercise under similar circumstances.

Accrued interest is an accrued expense (which is a type of accrued liability) and an asset if the company is a holder of debt—such as a bondholder. Prepaid expenses are an asset on your balance sheet as it reflects a future value—multiple months of a social media management tool—for your business. Then every month, you need to make an adjustment to reflect the monthly expense of the subscription. Learn how to build, read, and use financial statements for your business so you can make more informed decisions.

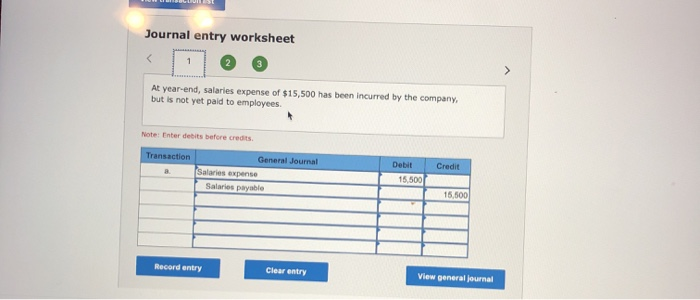

Since accrued expenses represent a company’s obligation to make future cash payments, they are shown on a company’s balance sheet as current liabilities. The company must make journal entries to record accruals on the balance sheet to reflect the revenues and expenses that have been earned or incurred but not yet recorded. A company would make a journal entry to if an expense has been incurred but will be paid later, then: record the revenue from that service as an accrual if it’s provided a service to a customer but hasn’t yet received payment. This would involve debiting the “accounts receivable” account and crediting the “revenue” account on the income statement. Written notice of the meeting must be given to all members whether or not they are entitled to vote at the meeting.

After receipt of the dissenting member’s demand notice and approval of the amendment, the cooperative has 60 days to rescind the amendment or otherwise the cooperative shall remit the fair value for the member’s interest to the dissenting member by 180 days after receipt of the notice. Upon receipt of the fair value for the membership interest, the member has no further member rights in the cooperative. Accrued expenses, which are a type of accrued liability, are placed on the balance sheet as a current liability. That is, the amount of the expense is recorded on the income statement as an expense, and the same amount is booked on the balance sheet under current liabilities as a payable.