Also, remember that you don’t need to be applying for small business capital or seeking investment to calculate or care about your debt-to-equity ratio. Among other financial ratios, understanding your debt-to-equity ratio can give you a good sense of goals you need to set for your business, and the direction you want to move. And you never know—sometimes you have to seek capital in an emergency, so being prepared with strong business financials can benefit you in the long run. Perhaps 53.6% isn’t so bad after all when you consider that the industry average was about 75%. The result is that Starbucks has an easy time borrowing money—creditors trust that it is in a solid financial position and can be expected to pay them back in full.

What is your risk tolerance?

The debt-to-equity ratio is an essential tool for understanding a company’s financial stability and risk profile. By analyzing this ratio, stakeholders can make more informed decisions regarding investments and lending, ultimately contributing to better financial outcomes. The D/E ratio can be skewed by factors like retained earnings or losses, intangible assets, and pension plan adjustments. Therefore, it’s often necessary to conduct additional analysis to accurately assess how much a company depends on debt. It is crucial to consider the industry norms and the company’s financial strategy when assessing whether or not a D/E ratio is good.

What Does a Negative D/E Ratio Signal?

In most cases, liabilities are classified as short-term, long-term, and other liabilities. For companies that aren’t growing or are in financial distress, the D/E ratio can be written into debt covenants when the company borrows money, limiting the amount of debt issued. For growing companies, the D/E ratio indicates how much of the company’s growth is fueled by debt, which investors can then use as a risk measurement tool. When making comparisons between companies in the same industry, a high D/E ratio indicates a heavier reliance on debt.

- Debt-to-equity ratios are not a one-size-fits-all formula and are dependant on a variety of factors.

- Also, not all industries are created equal when it comes to debt and how it’s leveraged.

- High leverage ratios in slow-growth industries with stable income represent an efficient use of capital.

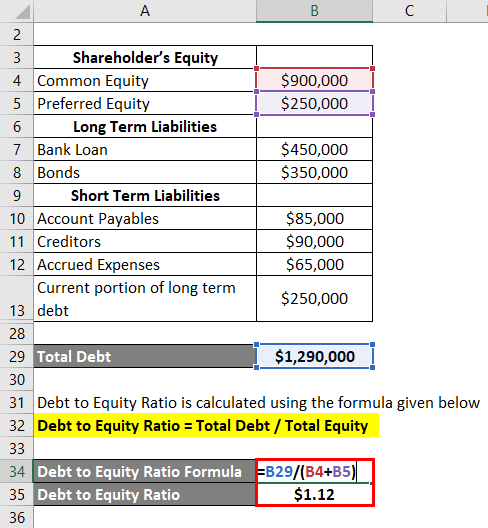

Balance Sheet Assumptions

Therefore, even if such companies have high debt-to-equity ratios, it doesn’t necessarily mean they are risky. For example, companies in the utility industry must borrow large sums of cash to purchase costly assets to maintain business operations. However, since they have high cash flows, paying off debt happens quickly and does not pose a huge risk to the company. Including preferred stock as debt can inflate the D/E ratio, making a company appear riskier, whereas counting it as equity would lower the ratio, potentially misrepresenting the company’s financial leverage.

Why Debt Capital Matters

This is a particularly thorny issue in analyzing industries notably reliant on preferred stock financing, such as real estate investment trusts (REITs). Changes in long-term debt and assets tend to affect the D/E ratio the most because the numbers involved tend to be larger than for short-term debt and short-term assets. If investors want to evaluate a company’s short-term leverage and its ability to meet debt obligations that must be paid over a year or less, they can use other ratios. See JSI’s FINRA BrokerCheck and Form CRS for further information.JSI uses funds from your Treasury Account to purchase T-bills in increments of $100 “par value” (the T-bill’s value at maturity). The value of T-bills fluctuate and investors may receive more or less than their original investments if sold prior to maturity.

Interpreting the Results

Meanwhile, a debt ratio of less than 100% indicates that a company has more assets than debt. Used in conjunction with other measures of financial health, the debt ratio can help investors determine a company’s risk level. A ratio greater than 1 shows that a considerable amount of a company’s assets are funded by debt, which means the company has more liabilities than assets. A high ratio indicates that a company may be at risk of default on its loans if interest rates suddenly rise. A ratio below 1 means that a greater portion of a company’s assets is funded by equity.

This is because the industry is capital-intensive, requiring a lot of debt financing to run. Additional factors to take into consideration include a company’s access to capital and why they may want to use debt versus equity for financing, such as for tax incentives. As an example, the furnishings company Ethan Allen (ETD) is a competitor to Restoration Hardware. The how to pitch a business idea in 2021 10-K filing for Ethan Allen, in thousands, lists total liabilities as $312,572 and total shareholders’ equity as $407,323, which results in a D/E ratio of 0.76. The debt-to-equity ratio is a way to assess risk when evaluating a company. The ratio looks at debt in relation to equity, providing insights into how much debt a company is using to finance its operations.

Share values rise if leverage has generated more earnings than the cost of the debt, but if the costs outweigh the earnings, values can decline. Since interest rates change over time, it can be risky to borrow in some cases. Gearing ratios describe a variety of financial ratios, one of which is the debt-to-equity ratio. They are used by various companies and professionals to evaluate the financial adequacy of their borrowers. The term gearing refers to financial leverage and is more of a theoretical concept, not a precise calculation and is open to interpretation.

The higher the debt ratio, the more leveraged a company is, implying greater financial risk. At the same time, leverage is an important tool that companies use to grow, and many businesses find sustainable uses for debt. It’s great to compare debt ratios across companies; however, capital intensity and debt needs vary widely across sectors.

Even though shareholder’s equity should be stated on a book value basis, you can substitute market value since book value understates the value of the equity. Market value is what an investor would pay for one share of the firm’s stock. The energy industry, for example, only recently shifted to a lower debt structure, Graham says. However, a low D/E ratio is not necessarily a positive sign, as the company could be relying too much on equity financing, which is costlier than debt. This ratio compares a company’s equity to its assets, showing how much of the company’s assets are funded by equity.