Over this period, their debt has increased from about $6.4 billion to $12.5 billion (2). It’s useful to compare ratios between companies in the same industry, and you should also have a sense of the median or average D/E ratio for the company’s industry as a whole. However, if that cash flow were to falter, Restoration Hardware may struggle to pay its debt. Investors can use the D/E ratio as a risk assessment tool since a higher D/E ratio means a company relies more on debt to keep going. Gearing ratios focus more heavily on the concept of leverage than other ratios used in accounting or investment analysis.

How Businesses Use Debt-to-Equity Ratios

In the banking and financial services sector, a relatively high D/E ratio is commonplace. Banks carry higher amounts of debt because they own substantial fixed assets in the form of branch networks. Higher D/E ratios can also tend bookkeeping for your business to predominate in other capital-intensive sectors heavily reliant on debt financing, such as airlines and industrials. What counts as a “good” debt-to-equity (D/E) ratio will depend on the nature of the business and its industry.

Debt-to-Equity (D/E) Ratio Formula and How to Interpret It

If the D/E ratio gets too high, managers may issue more equity or buy back some of the outstanding debt to reduce the ratio. Conversely, if the D/E ratio is too low, managers may issue more debt or repurchase equity to increase the ratio. Investors may check it quarterly in line with financial reporting, while business owners might track it more regularly. Currency fluctuations can affect the ratio for companies operating in multiple countries. It’s advisable to consider currency-adjusted figures for a more accurate assessment. Overall, the D/E ratio provides insights highly useful to investors, but it’s important to look at the full picture when considering investment opportunities.

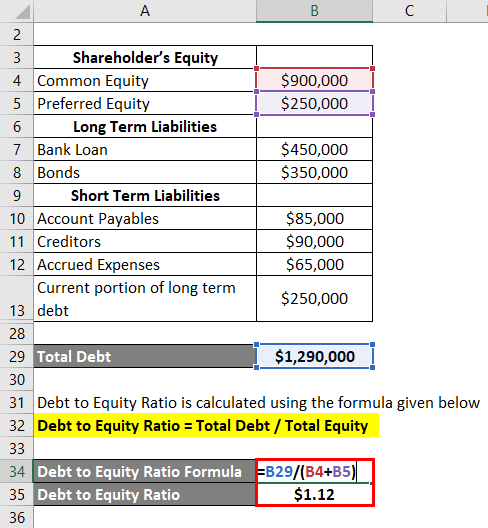

How to Calculate D/E Ratio?

This is in contrast to a liquidity ratio, which considers the ability to meet short-term obligations. In general, a lower D/E ratio is preferred as it indicates less debt on a company’s balance sheet. However, this will also vary depending on the stage of the company’s growth and its industry sector. D/E ratios should always be considered on a relative basis compared to industry peers or to the same company at different points in time. A company’s management will, therefore, try to aim for a debt load that is compatible with a favorable D/E ratio in order to function without worrying about defaulting on its bonds or loans.

- A debt ratio of 30% may be too high for an industry with volatile cash flows, in which most businesses take on little debt.

- Although T-bills are considered safer than many other financial instruments, you could lose all or a part of your investment.

- A good D/E ratio of one industry may be a bad ratio in another and vice versa.

- With this information, investors can leverage historical data to make more informed investment decisions on where they think the company’s financial health may go.

- As noted above, a company’s debt ratio is a measure of the extent of its financial leverage.

- All investments involve the risk of loss and the past performance of a security or a financial product does not guarantee future results or returns.

Different industries vary in D/E ratios because some industries may have intensive capital compared to others. Managers can use the D/E ratio to monitor a company’s capital structure and make sure it is in line with the optimal mix. This could lead to financial difficulties if the company’s earnings start to decline especially because it has less equity to cushion the blow. A good D/E ratio of one industry may be a bad ratio in another and vice versa. Generally, a D/E ratio of more than 1.0 suggests that a company has more debt than assets, while a D/E ratio of less than 1.0 means that a company has more assets than debt. The principal payment and interest expense are also fixed and known, supposing that the loan is paid back at a consistent rate.

The concept of a “good” D/E ratio is subjective and can vary significantly from one industry to another. Industries that are capital-intensive, such as utilities and manufacturing, often have higher average ratios due to the nature of their operations and the substantial amount of capital required. Therefore, it is essential to align the ratio with the industry averages and the company’s financial strategy.

In fact, a firm that uses its leverage to capitalize on a high-return project will likely outperform one that uses very little debt but sits in an unfavorable position in its industry, he says. For example, utilities tend to be a highly indebted industry whereas energy was the lowest in the first quarter of 2024. Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail. Lenders and investors perceive borrowers funded primarily with equity (e.g. owners’ equity, outside equity raised, retained earnings) more favorably. So, the debt-to-equity ratio of 2.0x indicates that our hypothetical company is financed with $2.00 of debt for each $1.00 of equity. Finally, the debt-to-equity ratio does not take into account when a debt is due.

Plans are self-directed purchases of individually-selected assets, which may include stocks, ETFs and cryptocurrency. Plans are not recommendations of a Plan overall or its individual holdings or default allocations. Plans are created using defined, objective criteria based on generally accepted investment theory; they are not based on your needs or risk profile. You are responsible for establishing and maintaining allocations among assets within your Plan. See our Investment Plans Terms and Conditions and Sponsored Content and Conflicts of Interest Disclosure.