The adjusting journal entry for December would include a debit to accounts receivable and a credit to a revenue account. The company would record a credit to decrease accounts receivable and a debit to increase cash the following month when the cash is received. They are recorded on the company’s balance sheet as current liabilities and adjusted at the end of an accounting period. A contribution agreement, whether made before or after the formation of a cooperative, must be paid or performed in full at the time or times, or in the installments, if any, specified in the contribution agreement. At the request of any member, the cooperative shall state in writing the particular membership interest owned by that member as of the date the cooperative makes the statement. The statement must describe the member’s rights to vote, if any, to share in profits and losses, and to share in distributions, restrictions on assignments of financial rights under section 308B.605, subdivision 3, or voting rights under section 308B.555 then in effect, as well as any assignment of the member’s rights then in effect other than a security interest.

- In each calendar year in which a renewal is to be filed, a cooperative must file with the secretary of state by December 31 of that calendar year a renewal containing the items required by section 5.34.

- The first privilege to purchase membership interests may be satisfied by notice to other members that the membership interests are for sale and a procedure by which members may proceed to attempt to purchase and acquire the membership interests.

- “Patron” means a person or entity who conducts patronage business with the cooperative.

- The officers shall submit reports to the members at the regular members’ meeting covering the business of the cooperative for the previous fiscal year that show the condition of the cooperative at the close of the fiscal year.

- A contribution agreement, whether made before or after the formation of the cooperative, is not enforceable against the would-be contributor unless it is in writing and signed by the would-be contributor.

- With an accrual basis, transactions are recorded when the work is done or the cost is acquired.

.625 RESTRICTION ON TRANSFER OR REGISTRATION OF MEMBERSHIP INTERESTS.

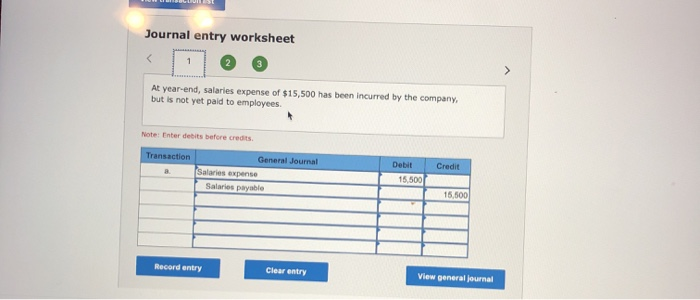

If, on Dec. 31, the company’s income statement recognizes only the salary payments that have been made, the accrued expenses from the employees’ services for December will be omitted. Prepaid expenses are payments made in advance for goods and services that are expected to be provided or used in the future. While accrued expenses represent liabilities, prepaid expenses are recognized as assets on the balance sheet. This is because the company is expected to receive future economic benefit from the prepayment.

Subd. 10.Domestic business entity.

The officers shall submit reports to the members at the regular members’ meeting covering the business of the cooperative for the previous fiscal year that show the condition of the cooperative at the close of the fiscal year. The regular members’ meeting shall be held at the principal place of business of the cooperative or at another conveniently located place as determined by the bylaws or the board. (2) the power of a court to compel the production of the cooperative’s records for examination. (c) The officers, other than the chief executive officer, shall not have the authority to bind the cooperative except as authorized by the board. (e) “Special legal counsel” means counsel who has not represented the cooperative or a related organization, or a director, manager, member of a committee of the board, or employee whose indemnification is in issue.

Subdivision 1.Action by affirmative vote of members.

Each cooperative governed by this chapter must file an annual renewal with the secretary of state in each calendar year after the calendar year in which the cooperative incorporated. Accrued expenses haven’t yet been paid, they’re considered an added liability on the balance sheet. By contrast, prepaid expenses are paid and are considered as assets on the balance sheet. When using accounting software, the software automatically creates the offsetting liability entry when the ledger expense is added. When it comes to monthly cash flow, a business should know how much money it needs to pay vendors for incurred expenses.

(b) If the articles, bylaws, or a member control agreement require a larger proportion than is required by this chapter for a particular action, the articles, bylaws, or the member control agreement shall have control over the provisions of this chapter. After mailing special or regular members’ meeting notices or otherwise delivering the notices, the cooperative shall execute a certificate containing the date of mailing or delivery of the notice and a statement that the special or regular members’ meeting notices were mailed or delivered as prescribed by law. All directors shall be elected at the regular members’ meeting for the terms of office prescribed in the bylaws, except for if an expense has been incurred but will be paid later, then: directors elected at district or unit meetings. A member is not, merely on the account of that status, personally liable for the acts, debts, liabilities, or obligations of a cooperative. A member is liable for any unpaid subscription for the membership interest, unpaid membership fees, or a debt for which the member has separately contracted with the cooperative. The board may employ a chief executive officer to manage the day-to-day affairs and business of the cooperative, and if a chief executive officer is employed, the chief executive officer shall have the authority to implement the functions, duties, and obligations of the cooperative except as restricted by the board.

(a) Except as provided in paragraph (b), a foreign cooperative is subject to chapter 303. Unless it complies with chapter 303, a foreign cooperative may not transact business in this state. “Cooperative” means an association organized under this chapter conducting business on a cooperative plan as provided under this chapter. Accrued expenses generally are taxes, utilities, wages, salaries, rent, commissions, and interest expenses that are owed.

Unless the articles or bylaws provide for a different membership or manner of appointment, a committee consists of one or more persons, who need not be directors, appointed by affirmative vote of a majority of the directors present. The board shall establish an audit committee to review the financial information and accounting report of the cooperative. The cooperative shall have the financial information audited for presentation to the members unless the bylaws allow financial statements that are not audited and the financial statements clearly state that they are not audited and the difference between the financial statements and audited financial statements that are prepared according to generally accepted accounting procedures. The audit committee shall ensure an independent review of the cooperative’s finances and audit. If a patron member director’s position becomes vacant or a new director position is created for a director that was or is to be elected by patron members, the board, in consultation with the directors elected by patron members, shall appoint a patron member of the cooperative to fill the director’s position until the next regular or special members’ meeting. If there are no directors elected by patron members on the board at the time of the vacancy, a special patron members’ meeting shall be called to fill the patron member director vacancy.

A cooperative may distribute net income to patron members in cash, capital credits, allocated patronage equities, revolving fund certificates, or its own or other securities. Net income allocated to patron members in excess of dividends on equity and additions to reserves shall be distributed to patron members on the basis of patronage. A cooperative may establish allocation units, whether the units are functional, divisional, departmental, geographic, or otherwise and pooling arrangements and may account for and distribute net income to patrons on the basis of allocation units and pooling arrangements. A cooperative may offset the net loss of an allocation unit or pooling arrangement against the net income of other allocation units or pooling arrangements. Any contribution rights agreement must be in writing and the writing must state in full, summarize, or include by reference all the agreement’s terms, provisions, and conditions of the rights to make contributions. (2) the fact of contribution and the contribution’s accorded value are both reflected in the required records of the cooperative.

Accrued liabilities, which are also called “accrued expenses,” only exist when using an accrual method of accounting. Under accrual accounting all expenses are to be recorded in financial statements in the period in which they are incurred, which may differ from the period in which they are paid. The expenses are recorded in the same period when related revenues are reported to provide financial statement users with accurate information regarding the costs required to generate revenue. If authorized by the articles, the cooperative may solicit and issue nonpatron membership interests on terms and conditions determined by the board and disclosed in the articles, bylaws, or by separate disclosure to the members.

If the vacating director was not elected by the patron members or a new director position is created, unless otherwise provided in the articles or bylaws, the board shall appoint a director to fill the vacant position by majority vote of the remaining or then serving directors even though less than a quorum. At the next regular or special members’ meeting, the members or patron members shall elect a director to fill the unexpired term of the vacant director’s position. The interest owed is booked as a $500 debit to interest expense on Company ABC’s income statement and a $500 credit to interest payable on its balance sheet.